Here is a sample that showcases why we are one of the world’s leading academic writing firms. This assignment was created by one of our UK assignment writers and demonstrated the highest academic quality. Place your order today to achieve academic greatness.

This report is based on proposing the corporate strategy for Vodafone which acquired European Liberty. In this report, the primary emphasises has been on examining the external environment of Vodafone which has been performed using two renowned frameworks for macro-environment analysis named as PESTLE framework and Porter 5 Forces.

Moreover, the report also contemplates the internal environment analysis of the brand using Value Chain analysis and VRIO framework which have been considered remarkable tools to evaluate the internal capability of an organisation. Additionally, the core competencies and resources of Vodafone have been specified to comprehend the strengths and weaknesses of a brand.

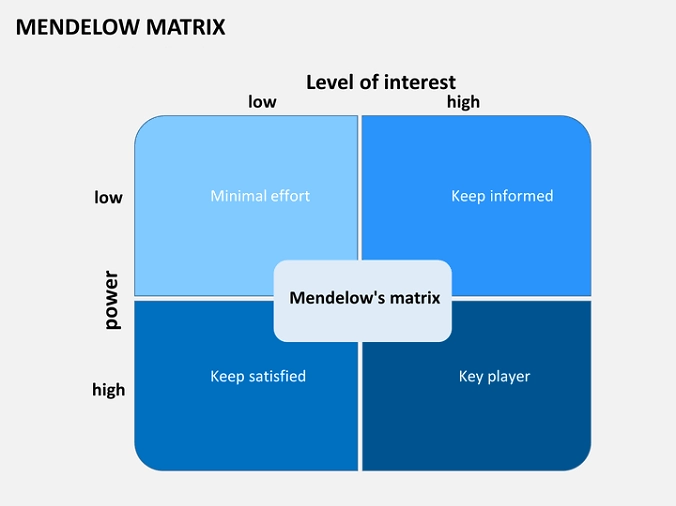

The strategy of Vodafone is then evaluated using SWOT and TOWS matrix along with Mendelow’s Matrix to contemplate the suitability and acceptability of the strategy employed. Furthermore, the feasibility of the strategy has been evaluated by specifying the financial facts and contribution of the strategy to the development of human resource skills within the firm. Lastly, a brief and succinct conclusion has been provided.

Figure 1: PESTLE (Srdjevic, Bajcetic and Srdjevic, 2012)

The study of Srdjevic, Bajcetic and Srdjevic (2012) contemplated that the PESTLE framework comprises six elements that play a significant role in affecting the external environment of the organisation. The same author added that the six elements of the PESTLE framework are political factors, social factors, environmental factors, economic factors, technological factors and legal factors (Srdjevic, Bajcetic and Srdjevic, 2012). The current report highlights the threats and opportunities in the macro-environment with the help of PESTLE analysis.

According to the research of Klauer (2015), the government pressure has increased with the emergence of the twenty-first century which created considerable challenges for international brands like Vodafone to comply with the communication regulations of a nation. Similarly, the study of Pratap (2019) found that trade tariffs and regulation established by the government of technology has raised a serious threat for Vodafone in the UK after becoming an independent state from European Union due to Brexit.

The study of Pratap (2019) identified that the efficiency of the financial market has been disturbed in the UK due to Brexit, the purchasing power tends to decline and inflation has been increased which can be considered a significant threat for Vodafone when they acquire European Liberty. However, the study of Klauer (2015) asserted that the quality of infrastructure has been exceptional in the UK which was considered an opportunity by Vodafone when they innovated their telecommunication service across the UK.

In the research of Koufopoulos and Gullett (2009), the author identified that the socio-cultural environment of the UK has been highly technical, people of the UK appreciate innovation and welcomes the latest technology which gives an extensive window to Vodafone to expand their business across the UK after acquiring the resources and technology of European Liberty. The study of Pratap (2019) contemplated that the entrepreneurial culture is common among the people of the UK when the news of the Vodafone acquisition reaches the investors, there is extensive opportunity for the telecom brand to increase its market share.

Furthermore, the study of Pratap (2019) indicated that the introduction of 5G has created a range of opportunities for Vodafone to expand their business; but, on the other hand, the concern of Brexit increased the risk of loss as well. In addition, the study by Klauer (2015) regarded that the people of the UK are tech-savvy and enjoy consuming the greatest quality internet and telecommunication services. Hence, the MyVodafone application facilitated the brand in maintaining a fruitful relationship with consumers while offering supreme quality 5G service.

According to the study of Koufopoulos and Gullett (2009), the people of the UK are high environment conscious, hence, the involvement of Vodafone in corporate social responsibility to bring sustainability to the environment has been regarded as a favourable opportunity for the brand during the process of acquisition.

The research of Klauer (2015) highlighted that telecommunication brands like Vodafone have to abide by anti-trust laws as part of the wireless communication industry to operate legally in the territory of the UK. Furthermore, the study of Saplitsa (2008) specified that data protection laws, health and safety laws and consumer protection laws can create a threat for Vodafone during the acquisition process if the brand does not follow them.

Professional editors proofread and edit your paper by focusing on:

Figure 2: Porter 5 Forces (Al-Atiqi and Mumen, 2014)

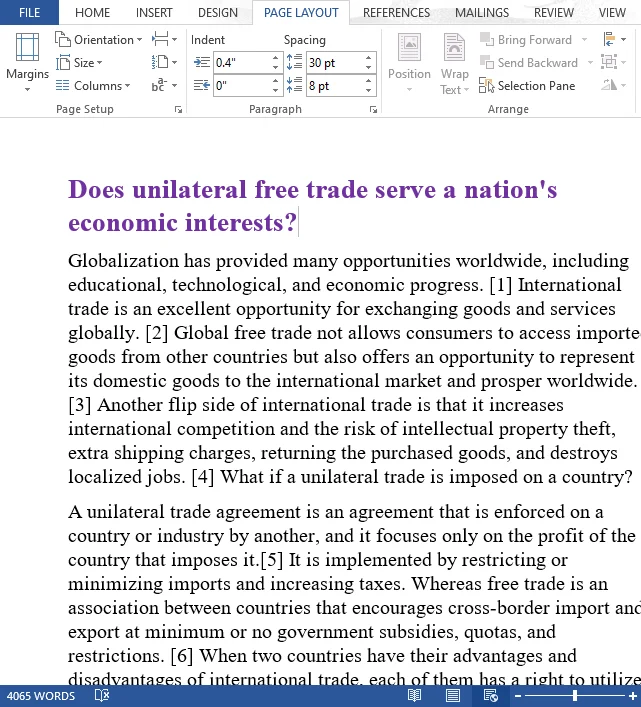

According to the study of Klauer (2015), the five competitive forces model was proposed by Michael Porter in 1979 which has been facilitating a range of businesses and organisations in examining the attractiveness of their industry. There are five determinants of competitive forces recognised competitive rivalry, bargaining power of suppliers and buyers, and the threat of new entrants and substitutes (Sirat, Asvial and Adyawardhani, 2008).

The report of Al-Atiqi and Mumen (2014) asserted that the economies of scale have been major criteria that gave benefit to Vodafone in competing with their rivals, as Vodafone provides a great range of products and services and has a cost advantage which gave little or low power to their competitors to penetrate the telecommunication and wireless industry of UK. Additionally, it has been found that Vodafone employs a product differentiation strategy to position its product as unique and effective which drives numerous telecom consumers in the UK towards the brand (Al-Atiqi and Mumen, 2014).

In the research of Klauer (2015), the author described that there is a range of suppliers in the telecommunication industry as compared to many buyers which makes the supplier weak and low. Furthermore, the same researcher added that these extensive ranges of suppliers provide standardised products which gave huge capacity and options to Vodafone in selecting cheap and reliable suppliers (Klauer, 2015).

The study of Saplitsa (2008) identified that there are fewer firms in the UK that offer telecommunication services and supporting products, thus, the buyers have minimum option to purchase the product or avail of the telecommunication service giving them low bargaining power against telecom brand like Vodafone in the UK. Similarly, the study of Al-Atiqi and Mumen (2014) described that in the telecom sector, the buyers have more emphasises on quality over price which gives them little or no power for bargaining.

The study of Murphy (2018) contemplated that Vodafone has been focusing on a cost leadership pricing strategy which gave them a competitive advantage over their competitors. The same author added that Vodafone experienced low threat from the substitutes as there are a low number of brands offering telecom service across the UK and their product range is somewhat similar to what has been offered by Vodafone.

According to the study by Al-Atiqi and Mumen (2014), Vodafone has been operating in the UK for decades and has successfully captured a large portion of the telecommunication market share across the UK due to which there is a low threat of new entrants for the brand as Vodafone offers their services and products in competitive pricing giving less window to new entrants to offer their product in low price.

According to the study by Addison (2010), Vodafone has been regarded as one of the largest telecommunication groups across the world in terms of its turnover. Additionally, the study of Vodafone (2020) described that Vodafone has an extensive equity interest in around twenty-five nations and partner networks in approximately forty-one states. Moreover, the report of Vodafone (2020) highlighted that Vodafone is considered the second largest telecom group in the world after the brand named China Mobile. It has been found that the reason behind the successful operation of Vodafone across the globe is the integration of the brand with internal as well as external factors which contributed to raising the strategic capability of the firm (Vodafone, 2020). The physical and intangible resources of Vodafone have been described below:

The study of Addison (2010) stated that there are numerous products and services offered by Vodafone which include voice service, social products, messaging services and roaming services. Whereas, the study of Vodafone (2020) described that Vodafone also offers Vodafone Live, USB modems, and Vodafone Live! With 3G and Vodafone mobile data cards. According to the report of Vodafone (2020), the primary reason for offering a range of products and services is to deepen the connection with the consumer which is a key strength of Vodafone.

In terms of human resources, Vodafone considers its employees as key assets and treats them accordingly to keep their morale at the highest level and get the extensive outcome (Addison, 2010). Similarly, the study of Vodafone (2020) contemplated that Vodafone emphasises accelerating the digital transformation which is why the brand considers its team as crucial and contributed to the successful strategic development of the brand in various markets across the world.

The report of Vodafone (2020) described that in terms of financial strength, Vodafone focuses on optimum utilisation of assets that do not raise the extensive operating cost and play a vital role in raising the revenue. Additionally, the same report stated that the company uses a cost leadership pricing strategy that assisted the brand in capturing a huge market share of the telecom industry and increasing its overall profit (Vodafone, 2020).

According to the study of Addison (2010), the intangible resources of Vodafone involve brand reputation across various markets around the globe which assisted them in penetrating multiple markets. The report of Vodafone (2020) added that Vodafone optimised its portfolio according to the demand of the different markets and its brand reputation acted as a key strength for capturing share in such markets.

According to the study by Mudambi and Puck (2016) value chain analysis is a strategic tool that can be used to identify the internal activities of a company or an organisation. Furthermore, by analysing the internal activities of Vodafone, the advantages and disadvantages of the company can be revealed.

Therefore, the value chain of Vodafone follows a planning process and the use of sources to gain a competitive advantage. Furthermore, Vodafone has different activities that are related to one another. The value chain of Vodafone follows an improved flow which is linked to the materials, information, and finances.

The flow of information enables the company to identify and capitalise on improved opportunities and minimise external threats. Furthermore, the material and product flow of the company can be increased through the improved forecasting methods of R&D, automation, and manufacturing of products.

Moreover, the value chain of Vodafone also includes the aspect of inventory management which enables Vodafone to reduce the delays in activities by active monitoring and tracking throughout the supply chain. Similarly, the aspect of marketing is also involved in the value chain of Vodafone which provides customers with fitting access to the information related to the product.

After-sales service is also a valuable activity for Vodafone because an uninterrupted flow of information between the customer and the company can elevate their relationship. Therefore, the primary activities of Vodafone involve the production and selling of products to their targeted customer base. Similarly, the secondary activities of Vodafone such as firm infrastructure, HRM, technology development, and Procurement are also valuable for the operations of the company.

| Infrastructure | Quality management | Legal matters | Accounting and financing | Strategic management | |

| HRM | Hiring, training, performance, and personnel management. | ||||

| Technology Development | Automation | Technology-based customer service | Product design | R&D | |

| Procurement | Purchasing equipment and raw materials | ||||

| Inbound logistics

Raw materials for production and distribution |

Operations

Manufacturing, assembling, testing, repairing, and maintenance. |

Outbound logistics

Handling, warehousing, processing, transportation, and delivery. |

Marketing and sales

Salesforce, advertising, promotion, pricing, and placement. |

Service

Pre-sale and post-sale services. |

|

Table 1. Value Chain of Vodafone

According to the study by Knott (2015), firms use VRIO analysis to identify their internal resources to gain a competitive advantage. Therefore, the resources must be valuable, rare, impossible to imitate, and organised to capture value. Similarly, this report focuses on the VRIO framework of Vodafone to analyse the internal activities of the company.

| Resource/Capability | Valuable | Rare | imitable | Organisational support | Competitive Advantage |

| Post-sales services | Yes | No | Yes | Yes | Sustainable competitive advantage |

| Advertising and marketing | Yes | No | No | Yes | Temporary competitive advantage |

| Manufacturing and assembly | Yes | Yes | No | Yes | Competitive advantage |

| R&D | Yes | Yes | No | Yes | Competitive advantage |

| Product Design | Yes | Yes | No | Yes | Competitive advantage |

Table. 2 VRIO Framework of Vodafone

The study of Frasquet, Mollá and Ruiz (2015) mentions that post-sales services are the most crucial aspect to develop a healthy relationship with the customers. Similarly, the post-sales services provided by Vodafone can be considered as the aspect which provides the company with a competitive advantage. Similarly, appropriate product marketing and advertising can lead to increased sales (De Mooij, 2018). Therefore, the product marketing of Vodafone provides a competitive edge to the company. Furthermore, manufacturing, R&D, and product are also non-imitable which makes the brand unique among customers.

According to the study by Klauer (2015), one of the greatest advantages that Vodafone has is offering telecommunication service at minimum cost with guaranteed quality. The same study described that the cost leadership strategy boasted off the sales of Vodafone and facilitated the marketing team in getting a competitive advantage (Klauer, 2015). Additionally, the value chain analysis of Vodafone described that the brand manages its quality by purchasing optimum quality raw material which is utilised in manufacturing products like USB modem and more. Moreover, the activities of hiring, training, performance, and personnel management are properly monitored at Vodafone to build competent staff which helps a brand in getting a competitive advantage in the telecommunication industry.

The study of Klauer (2015), described that the core competency of Vodafone has been highly dependent on innovative products and unique selling proposition. The same author described that Vodafone was among one the brands that introduced the services of 5G internet across various markets around the world which gave them a competitive advantage (Klauer, 2015). Moreover, the above internal and external analysis evaluated that the core competency of Vodafone has been cost leadership pricing strategy, differentiation and considering the following options for generic competitive strategy: low-cost competency, uniqueness competency, narrow target and border target.

The SWOT analysis and TOWS matrix have been employed to evaluate the suitability of the strategy

Strengths

|

Weaknesses

|

Opportunities

|

Threats

|

Table 1: SWOT Vodafone (Murphy, 2018; Koufopoulos and Gullett, 2009; Al-Atiqi and Mumen 2014; Klauer, 2015)

| Internal

External |

Strengths

S1 Brand Equity S2 Product Differentiation S3 Technological Innovation |

Weaknesses

W1 Weak Position in the US W2 Less Mobile Consumers in Europe |

| Opportunities

O1 Digital Marketing O2 Innovation and Technology O3 Customer Engagement |

SO

|

WO |

| Threats

T1 Brexit Uncertainty T2 Competition T3 Regulatory Threats |

ST | WT |

Table 2: TOWS Matrix (Murphy, 2018; Koufopoulos and Gullett, 2009; Al-Atiqi and Mumen 2014; Klauer, 2015)

The above figure illustrated the TOWS matrix, the strength of product differentiation (S1) and the opportunity of innovation and technology (O2) would act as a key determinant for Vodafone as they acquire European Liberty. Digital marketing (O1) and technological innovation (S3) can be integrated into a term of 5G technology which can be marketed through the internet when Vodafone break the news of acquiring European Liberty which would attract a range of consumers of European Liberty and Vodafone and increase the sales and revenue for the acquired brand. As it has been mentioned that brand equity (S1) is a key strength of Vodafone which would assist the brand in getting more engagement from a customer (O3) when they acquire European Liberty.

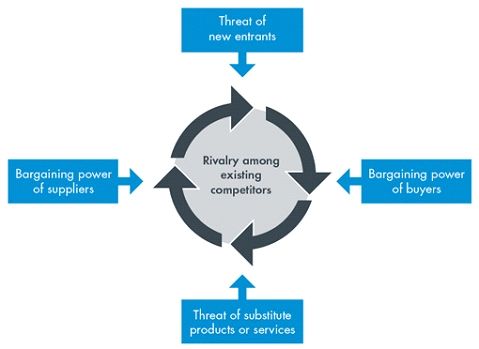

Figure 3: Mendelow’s Matrix (Bank, 2012)

The above Mendelow’s Matrix has been used to assess the acceptability of major stakeholders and players when Vodafone acquired European Liberty. By examining the report of Foster (2019), it has been identified that the European Commission lies in the quadrant of ‘keep satisfied’ as they possess high power but have little interest in the acquisition. The key players in this scenario are Vodafone and European Liberty as the stakeholders of both these firms are mostly involved. The shareholders, employees and suppliers of both the brand lie in the ‘keep informed’ quadrant as they have less power but are highly involved during the acquisition

The financial feasibility of the Vodafone and European Liberty acquisition has been determined by analysing the financial performance of both brands. It has been found that after the emergence of 5G, Vodafone has achieved substantial sales in the year 2020 however, the company is still in losses but the amount has been decreased to 455 million Euros as compared to the loss of 7,644 million euros in the fiscal year 2019 (Vodafone, 2020). But the cost leadership strategy and product differentiation would end up favourable for both Vodafone and European Liberty after the acquisition.

When the staff of Vodafone and European Liberty would work together, the company would improve the capacity for extending the quality of cable service offered by Vodafone and initiate new programs for training and developing employees so the acquired brand meets the quality standard of the market. The acquisition of Vodafone and European Liberty would together serve approximately 25 million homes and around 25 million subscriptions for broadband, video and fixed-line telephone along with 6 million mobile services (Foster, 2019).

Addison, A., 2010. Vodafone Annual Report 2010. [Online] Www-origin4-vp.vodafone.com. Available at: <https://www-origin4-vp.vodafone.com/content/annualreport/annual_report10/business/technology_and_resources.html> [Accessed 8 July 2020].

Al-Atiqi, A. and Mumen, F., 2014. The Strategic Alternatives of Vodafone UK in 2009.

Bank, K.F.K., 2012. Mendelow’s matrix. London: Kaplan Financial.

De Mooij, M., 2018. Global marketing and advertising: Understanding cultural paradoxes. SAGE Publications Limited.

Foster, A., 2019. EU Approves Liberty Global €19Bn Sale to Vodafone. [Online] IBC. Available at: <https://www.ibc.org/manage/eu-approves-liberty-global-19bn-sale-to-vodafone/4149.article> [Accessed 8 July 2020].

Frasquet, M., Mollá, A. and Ruiz, E., 2015. Identifying patterns in channel usage across the search, purchase and post-sales stages of shopping. Electronic Commerce Research and Applications, 14(6), pp.654-665.

Vodafone. 2020. [Online] Available at: <https://investors.vodafone.com/static-files/947ac784-3257-42e4-a543-ad7c5ea31d0e> [Accessed 8 July 2020].

Klauer, T., 2015. Valuation of Vodafone Group.

Knott, P.J., 2015. Does VRIO help managers evaluate a firm’s resources? Management Decision.

Koufopoulos, D.N. and Gullett, E., 2009. Planning for Global Dominance: The Case of Vodafone. U21Global Authentic Assessment Series No. AA-2009-028.

Mudambi, R. and Puck, J., 2016. A global value chain analysis of the ‘regional strategy’ perspective. Journal of Management Studies, 53(6), pp.1076-1093.

Murphy, E., 2018. Vodafone Group Plc Porter Five Forces Analysis. [Online] Essay48. Available at: <https://www.essay48.com/term-paper/12584-Vodafone-Group-Plc-Porter-Five-Forces> [Accessed 7 July 2020].

Pratap, A., 2019. Pestel Analysis of Vodafone Group – Notesmatic. [Online] notesmatic. Available at: <https://notesmatic.com/2019/05/pestel-analysis-of-vodafone-group/> [Accessed 7 July 2020].

Saplitsa, I., 2008. Business analysis and valuation of Vodafone Group (Master’s thesis).

Sirat, D., Asvial, M. and Adyawardhani, L., 2008. Mobile virtual network operator (mvno) in Indonesia: competitive business analysis using Porter 5 forces model. Electrical Engineering dept: Universitas Indonesia.

Srdjevic, Z., Bajcetic, R. and Srdjevic, B., 2012. Identifying the criteria set for multicriteria decision making based on SWOT/PESTLE analysis: a case study of reconstructing a water intake structure. Water resources management, 26(12), pp.3379-3393.

Vodafone. 2020. What We Do. [Online] Available at: <https://www.vodafone.com/what-we-do> [Accessed 8 July 2020].

To write an excellent introduction for an Undergraduate Business Assignment, provide a concise overview of the topic, state its relevance, and present a clear thesis statement outlining the main objectives. Engage the reader from the start and set the tone for the rest of the assignment.

You May Also Like