Here is a sample that showcases why we are one of the world’s leading academic writing firms. This assignment was created by one of our expert academic writers and demonstrated the highest academic quality. Place your order today to achieve academic greatness.

The production decisions in a sector depend upon many factors, including the demand in the market and the available supply of raw materials. The theory of production in economics explains the production decisions of businesses for determining the amount of commodity to be produced along with how much raw materials and labour, along with other costs, will be used.

The topic of this report is to analyse the production decisions in the UK manufacturing industry between 2010 to 2019. This report analyses how and when the inputs and costs impact the production decisions concerning the supply of goods and services. This report also incorporates the rule of perfect competition or a highly competitive market on the supply of goods and services. This report has drawn references to the UK economy and the automotive industry between 2010 and 2019.

Impact of inputs and costs in the production decisions on the production decisions in the supply of goods and services

Based on the theory of production, there is a relationship between the prices of commodities and the cost of productive factors, including the wages and rents used to produce. Additionally, there is a linkage between the productive factors and the prices of commodities along with the quantities of the commodities produced along with the productive factors.

The production decisions by businesses depend upon multiple layers of increasing complexity (Young, 2021). This includes the decisions made regarding the methods of deduction of a particular quantity of output in a manufacturing facility having space and size along with equipment limitations.

This incorporates the challenges attributed to short-run cost minimisation. The second layer of decision-making regarding production involves the determination of the best profitable quantities of products to be produced at any of the available manufacturing plants, which maximises short-run profit. The third layer of complexity regarding the choice of production includes identifying the best profitable size and equipment to be accommodated in the manufacturing plant for long-term profit maximisation.

An increase in the price of an input material required for production subsequently increases the cost of production. It increases the marginal cost of the business. This results in an upward shift of the MC curve to the left, resulting in the left word upward shift of the supply curve.

Hence, an increase in the input prices of materials harms the supply of the form concerning its products and services. A price ceiling is a legal minimum price at which a good can be sold in the market. The price ceiling imposed by the government is not binding if the demand for the product is below the limit.

However, the ceiling becomes binding if the government imposes a price ceiling less than the equilibrium price. The UK government had placed a price ceiling of 29.4% on the profits for the NHS in 2019 (Rodwin, M.A., 2021). This was done to ensure value-based pricing of the medicines given to the patients.

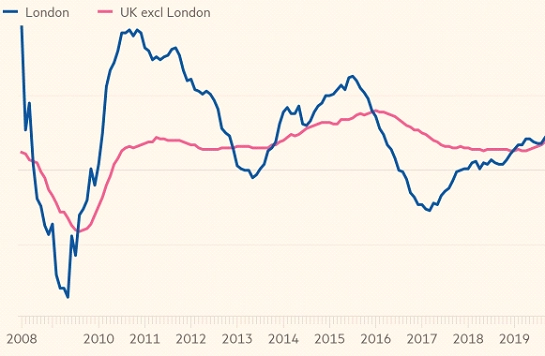

Rent control in the UK provides an example of a price ceiling in the short and long run. The goal of the UK government to increase housing affordability has led to a ceiling on rent. In the short run, the landlords had initially fixed the number of apartments and rooms to be rented. However, they couldn’t change the supply based on the market conditions (Krugman and Wells, 2020).

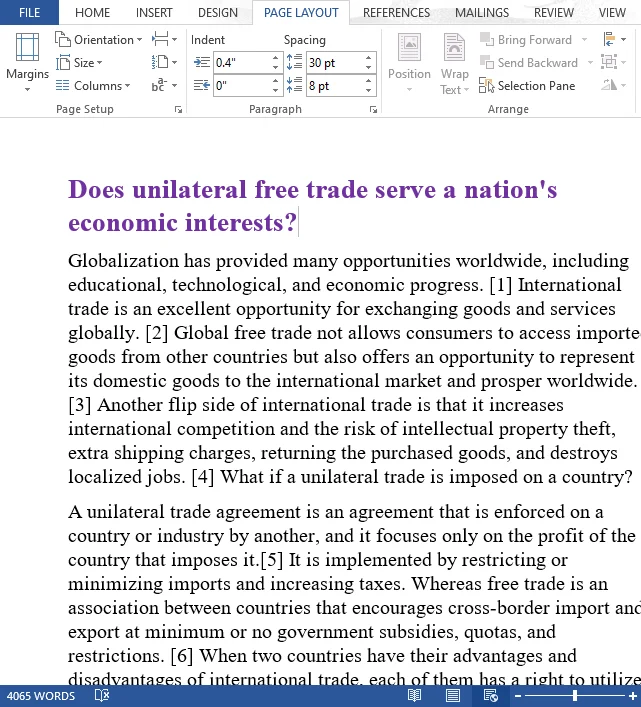

Additionally, the number of people searching for houses in the city remained moderate and not very high due to the time needed for adjusting to the housing arrangements in the short term. The change in rental prices in the UK displayed an upward progression since 2010 but started to dip in 2011 and steeped to the lowest during 2013 and 2017 while showing signs of recovery in 2019 (FT, 2021). The demand for rental properties in London was high in 2018-2019. Short-term supply and demand for the housing market remain inelastic.

Professional editors proofread and edit your paper by focusing on:

Figure 1: London rental prices. Source (FT, 2021)

In the long run, the sellers and buyers of rental properties respond more to the market conditions. Inputs and costs being lower than the loan repayments and mortgage lead to the landlord’s decision to not build new apartments and reduce the maintenance of the existing ones.

Figure 2: Rent control and demand/supply. Source: (Krugman and Wells, 2020).

A small housing shortage is created due to the short-run effects of rent control leading to the supply and demand curves for the apartments being inelastic due to the price ceiling of the rent control law. A large shortage is created due to the long-run effects of rent control due to the supply and demand curves being more elastic for the apartments (Krugman and Wells, 2020).

The minimum wage represents an important example of a price floor representing the lowest price that must be paid to the labour by the business to execute the production. In this case, an increase in the minimum wage impacts production decisions.

This is because the increase in minimum wage increases production costs and impacts the supply of specific goods and services based on their market demand. For example, despite the rising costs of raw materials and labour, automobile production in the UK has grown by increasing prices due to high market demand for export (ONS, 2019).

The cost-output relationship is based on the short term, as the total cost represents the money required for producing a particular quantity of product. The total cost of production is the summation of fixed and variable costs.

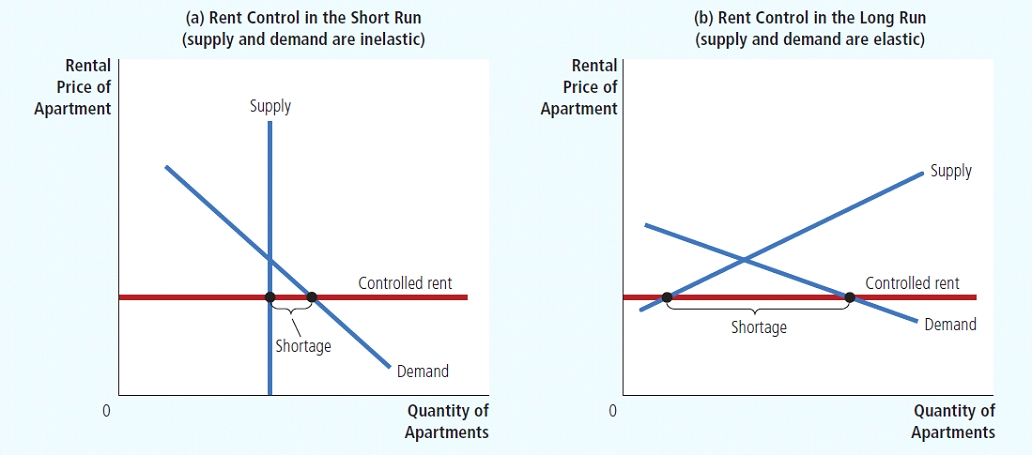

Figure 3: Consumer price inflation. Source: ONS (2021).

Consumer price inflation in the UK has been studied with occasional declines and rises from 2014 to 2017 (ONS, 2021). The consumer price index increase resulted in a subsequent decrease in occupiers’ housing costs. This is due to the reduction in demand for housing among the people as a consequence of increasing commodity prices.

Minimising short-run costs implies the production function as the business always intends to reduce manufacturing costs despite its number of commodities. Consideration of the product’s quality and the cost of the productive factors is considered a normal situation, leading to the decision to use the cheapest combination of factors of production by the company.

This is done to produce the desired product by considering all the parameters and minimising costs in all areas. This is known as the production function and considers the relationship among quantities of factors used along with the number of products generated through production (Krugman and Wells, 2020).

The production function is utilised in the luxury automobile market of the UK as the luxury automakers like Rolls-Royce and Aston Martin intend to produce the highest quality of vehicles with modern amenities considering the costs and time while also optimising their operations to reduce costs (ONS, 2019).

The law of diminishing returns states that the increase of a particular input in the production of a commodity while fixing the other inputs at the same rate gradually results in the accomplishment of a fixed point. This incorporates the aspects amounting to progressively smaller editions of the inputs and subsequently diminishing the increases in the output. This is attributed to the quest of the hospitality service providers in the UK to recruit more staff to enhance productivity and include their capacity to handle more customers.

Impact of perfect competition on the supply of goods and services

Perfect competition is a situation represented through a theoretical market structure of competition when there are no monopolies in the market. Perfect competition is a market that represents all the operating businesses selling identical products to the consumers and all the companies being price takers as they cannot influence the market price (Young, 2021).

Perfect competition indicates the lack of influence on the prices by the market share of the businesses along with the complete freedom and detailed information presented to the buyers regarding the product being sold by the individual companies. Perfect competition empowers the consumers as they remain aware of the prices charged by the individual companies selling similar products, whereas businesses enjoy perfectly mobile capital and labour resources. The situation of perfect competition in a market results in freedom for businesses to enter or exit the market without any additional cost (Krugman and Wells, 2020).

Perfect competition or a highly competitive market benefits the buyers by keeping the prices of the products and services slow while ensuring the quality remains high. There is neither excess supply nor demand in a market of perfect competition as both the buyers and the producers takes the market price.

This situation results in the suppliers producing the products and services during the entire period of sales and market demand. This includes the suppliers’ decision to continue producing until they can recover a good price for the products that is more than the cost of production.

In this scenario, the buyers also keep purchasing the products and services until they are satisfied by paying the price. In perfect competition, the increase in the prices of a product leads to the entry of new operators in the market resulting in the establishment of clearing prices.

However, lowering prices in perfect competition results in the market exit of the suppliers and producers who cannot cover their costs (Krugman and Wells, 2020). The supply curve represents the quantities that the suppliers are willing to produce in perfect competition or a highly competitive market.

Figure 4: Demand-Supply curve in perfect competition. Source: (Krugman and Wells, 2020).

Higher price in perfectly competitive market results in production from a greater number of suppliers. The lower price of a product influences higher purchases by a greater number of consumers (Krugman and Wells, 2020). The demand curve represents the quantities consumers remain willing to pay at each price point. In the UK, the retail industry is highly competitive, with a perfect competition scenario among the operators.

The market share gap among the major industry operators like Tesco, Sainsbury’s, Asda and Marks and Spencer remains very small. The products sold by the major supermarkets of the UK are almost identical and similar encloses of grocery products and ready-to-eat foods.

The increase in operational costs and store maintenance of the supermarkets resulted in the closure of multiple outlets of Morrisons. The performance review of the 494 stores of the company resulted in the decision to close supermarkets in the country and risk 400 jobs (TheGuardian, 2019).

The decision was undertaken as the company was identified as the worst-performing among the industry’s market leaders, with a revenue reduction by 2.7%. The demand for the company’s products had also reduced as the customers put fewer items in their baskets while shopping at the facilities. The organisation’s market share had reduced from 10.3% to 10.1% in August 2019 compared to earlier the year 2018.

The demand and supply graph in a market with perfect competition represents the prices of the commodities on the vertical axis, whereas the horizontal axis displays the quantities. The first slope represents the supply as the increase in the price results in the willingness to increase production by the suppliers. The market entry of many grocery supermarkets and increased sales of online grocery companies, including AmazonFresh, represent the will of the suppliers to produce more due to higher demand and rises in price (TheGuardian, 2020).

The downward slope represents the demand for the products and services in a market with perfect competition. This represents the lesser purchase of commodities by consumers when prices become high. This is attributed to the purchase of less quantity of products by the consumers of Morrisons and the overall grocery market in the UK. This is also concerned with many other companies like Sainsbury’s and Marks and Spencer. There have been decisions from major UK-based grocery supermarkets to close the large stores and open more convenience stores as it deals with the trend of purchasing low quantities.

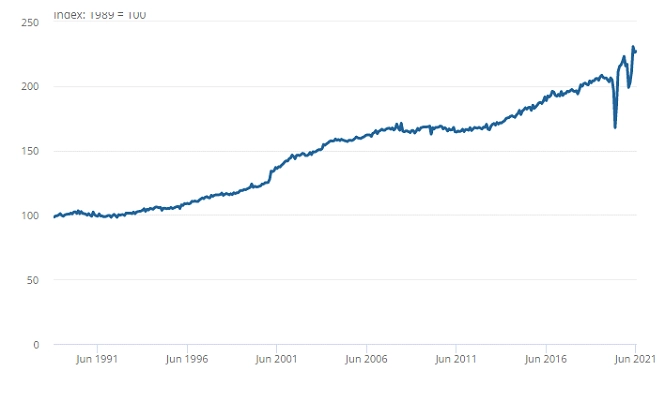

Figure 5: Total retail sales volume. Source: (ONS, 2021).

The total sales of UK-based retail businesses have increased due to the continuous purchase by the customers in the perfectly competitive market. It has often been witnessed that grocery supermarkets like Tesco and Sainsbury sell bulk quantities of products at very cheap rates below market prices.

This represents the clearing price designated by the intersection of the demand and supply curve in perfect competition. However, the prices continued to change based on consumer preference and better technology. The gradual increase in population had contributed to the need for more essential grocery products leading to a total increase in retail sales volume.

Electricity represents the relationship between the supply and demand of a product or service. The retail industry specialising in the sales of essential goods represents its insensitivity to price changes. This implies that the consumers are not affected in their purchase decisions, describing the increase in prices of food and clothes as a necessity for them.

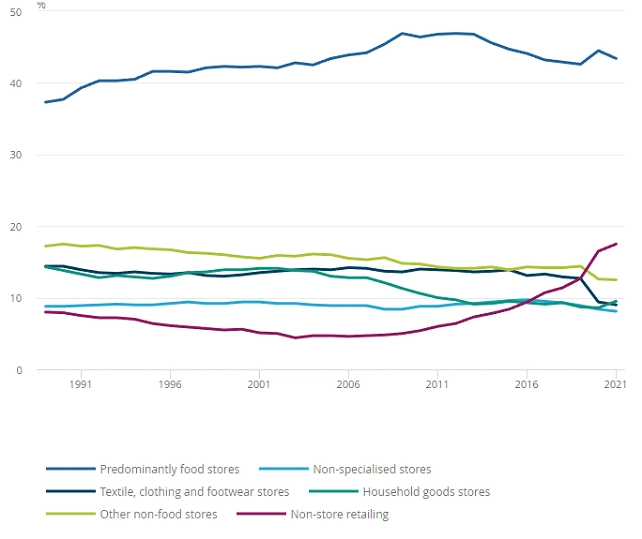

Figure 6: Share of expenditure. Source: (ONS, 2021).

Prices for inelastic goods like food and textile had increased, leading to almost similar purchase levels as prices are not affected.

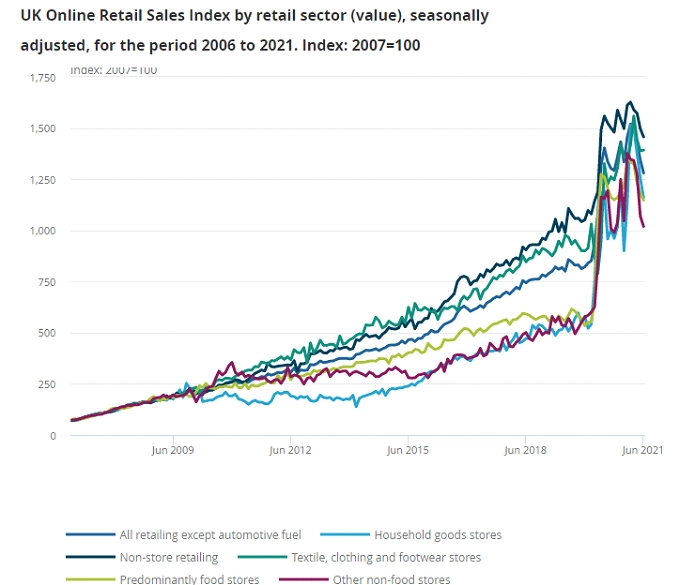

Figure 7: Online retail sales. Source: (ONS, 2021).

The increase in prices and input costs has led to the decision of many retailers in the UK to utilise digital channels for the sales of their products, along with migrating their operations. Numerous retailers have chosen to use digital channels to sell their products to ensure the delivery of value propositions and quality to customers.

Elastic commodities like non-store retailing along with footwear and household goods have migrated mostly to the online domain due to the demand being affected due to price. Many producers have shifted to the online domain for cost reduction and profit retention.

The report concludes that the inputs and costs impact the production decisions concerning the supply of goods and services during short-term profit maximisation. This is due to the quest the adopt the most profitable means of production despite the quantity and quality of production.

Inputs and costs influence production decisions as they can create a long-term impact on the market demand for the product leading to a loss of revenue for the producers due to less demand for quantity. Perfect competition is a market that includes multiple businesses sending the same categories and products to customers at similar prices.

This scenario is represented by increased demand for the products during low supply. There are no barriers to market entry and exit in perfect competition. The UK retail industry is based on perfect competition due to the companies having an almost similar market share and offering a similar quality of product to the customers at similar prices.

FT, 2021. Return of the renters: price hikes, bidding wars and bribes. [Online] Available at: https://www.ft.com/content/8c147c09-5eeb-4f9a-a4ab-e219895d6426 [Accessed 15 Dec 2021]

Krugman and Wells. 2020. Essentials of Economics. New York: Worth Publishers. Pages 355-451.

ONS, 2021. Consumer price inflation, UK: December 2020. [Online] Available at: https://www.ons.gov.uk/economy/inflationandpriceindices/bulletins/consumerpriceinflation/december2020 [Accessed 15 Dec 2021]

ONS. 2019. The UK motor vehicle manufacturing industry: 2008 to 2018. [Online] Available at: https://www.ons.gov.uk/businessindustryandtrade/manufacturingandproductionindustry/articles/theukmotorvehiclemanufacturingindustry2008to2018/2020-04-16 [Accessed 15 Dec 2021]

Rodwin, M.A., 2021. How the United Kingdom Controls Pharmaceutical Prices and Spending: Learning From Its Experience. International Journal of Health Services, 51(2), pp.229-237.

TheGuardian, 2019. Has Amazon Fresh chosen the prime moment to take on UK supermarkets? [Online] Available at: https://www.theguardian.com/business/2020/jul/31/has-amazon-fresh-chosen-the-prime-moment-to-take-on-uk-supermarkets [Accessed 15 Dec 2021].

TheGuardian, 2019. Morrisons shuts four supermarkets, putting 400 jobs at risk. [Online] Available at: https://www.theguardian.com/business/2019/aug/22/400-jobs-at-risk-as-morrisons-closes-four-stores [Accessed 15 Dec 2021]

Young, M. 2021 Lecture 6: Supply curve, inputs, and costs. MOD3327 Economics for Business. The Anglia Ruskin University of London.

Young, M. 2021 Lecture 7: Perfect competition and market efficiency. MOD3327 Economics for Business. Anglia Ruskin University of London.

The general formula to measure production cost is:

Total Production Cost = Fixed Costs + Variable Costs

where Fixed Costs are expenses that do not change with production levels, and Variable Costs are expenses that vary based on the quantity produced.

You May Also Like